Expert Advice on Picking Secure and Profitable Mining Machine Providers

In the ever-evolving landscape of cryptocurrencies, selecting the right mining machine provider can mean the difference between striking digital gold and facing costly setbacks. With Bitcoin (BTC) still reigning supreme as the pioneer of blockchain technology, and altcoins like Ethereum (ETH) and Dogecoin (DOG) captivating investors with their unique potentials, the demand for reliable mining solutions has skyrocketed. But how do you navigate this complex market? As experts in the field, we emphasize that security and profitability aren’t just buzzwords—they’re the bedrock of a successful mining operation. Whether you’re delving into the high-stakes world of BTC mining or exploring the lighter, community-driven vibes of DOG, choosing a provider that offers top-tier mining machines and hosting services is crucial.

Picture this: a world where your mining rig hums efficiently in a state-of-the-art facility, protected from hacks and hardware failures, while you reap the rewards from the latest ETH price surges. Mining machines, or rigs as they’re often called, are the heart of cryptocurrency extraction. These powerful devices, equipped with specialized ASICs or GPUs, crunch complex algorithms to validate transactions on networks like BTC’s blockchain. Yet, not all providers are created equal. A secure provider prioritizes robust cybersecurity measures, such as encrypted data transfers and multi-factor authentication, to shield your investments from the shadowy threats lurking in the crypto sphere. Meanwhile, profitability hinges on factors like energy efficiency, which directly impacts operational costs—especially when electricity prices fluctuate wildly.

Let’s dive deeper into the specifics. For BTC enthusiasts, where mining difficulty scales with network growth, opting for a provider with cutting-edge miners can optimize your hash rate and boost yields. These machines aren’t just tools; they’re gateways to financial independence. On the flip side, ETH mining, with its shift towards proof-of-stake, demands providers who adapt quickly to protocol changes, ensuring your setup remains viable. And don’t overlook DOG, that meme-fueled phenomenon; its lower entry barriers make it ideal for beginners, but you still need a reliable hosting service to manage the volatility. Mining farms, vast warehouses filled with synchronized rigs, offer a scalable solution, allowing individuals to pool resources without the hassle of home setups.

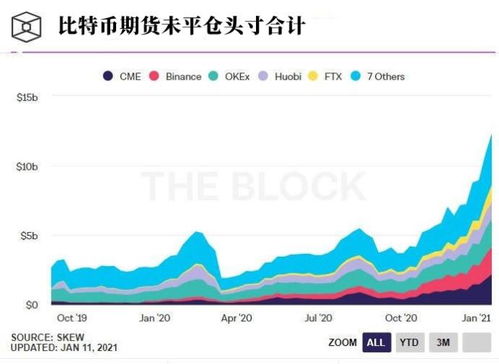

Now, when it comes to hosting mining machines, the decision becomes even more nuanced. Top providers offer remote hosting in climate-controlled facilities, often in regions with cheap electricity, like Iceland or parts of the United States. This not only enhances security—think 24/7 surveillance and fire suppression systems—but also maximizes uptime, a critical factor for profitability. Imagine waking up to see your ETH holdings appreciating while your hosted miner operates flawlessly in the background. Exchanges play a role here too; integrating with platforms like Binance or Coinbase can streamline the conversion of mined coins into fiat, but only if your provider supports seamless API connections. The burst of activity in the crypto market means providers must be agile, ready to handle sudden spikes in demand or regulatory shifts.

Variability in sentence structure keeps things fresh, doesn’t it? Short, impactful lines can punch through the noise, while longer ones weave a narrative that draws you in. Consider the miner: this individual or entity running the machines is the unsung hero, relying on providers for not just hardware but also expert guidance. A profitable setup might involve diversifying across BTC, ETH, and DOG to mitigate risks—after all, while BTC offers stability, ETH promises innovation, and DOG brings unpredictability. Mining rigs, with their arrays of fans and circuits, must be chosen based on specifications like hash power and thermal management, ensuring they withstand the rigors of continuous operation.

Moreover, the richness of vocabulary elevates the discussion. Terms like “hash rate,” “block reward,” and “network consensus” aren’t mere jargon; they represent the intricate dance of technology and finance. Providers that educate their clients on these aspects foster a more informed community, leading to better decision-making. For instance, in a mining farm dedicated to ETH, the focus might shift to energy-efficient rigs that align with the network’s environmental goals. And let’s not forget the infectious excitement of a successful mine— that moment when your DOG holdings skyrocket, all thanks to a secure, profitable provider who handled the backend seamlessly.

In conclusion, the path to secure and profitable mining machine providers winds through careful research, blending technical prowess with strategic foresight. Whether you’re a seasoned BTC miner or a newcomer to ETH and DOG, prioritize providers that offer transparent pricing, strong customer support, and innovative hosting options. By doing so, you’ll not only safeguard your investments but also unlock the full potential of the cryptocurrency revolution. The future is bright, pulsating with the rhythm of blockchain innovation—seize it wisely.

This insightful guide demystifies selecting mining machine providers, blending security checks with profit forecasts. Yet, it overlooks emerging blockchain risks—essential for savvy investors eyeing long-term gains!