Factors Driving the Mining Machine Hosting Market Surge in 2025

As the dawn of 2025 approaches, the mining machine hosting market is experiencing an unprecedented surge, propelled by a confluence of technological advancements, regulatory shifts, and the insatiable appetite for cryptocurrencies. This booming sector, which allows individuals and businesses to outsource the complexities of mining operations, is reshaping how we interact with digital assets like Bitcoin, Ethereum, and even the whimsical Dogecoin. Hosting services provide the infrastructure—secure data centers, reliable power supplies, and expert maintenance—that miners need to thrive without the burdens of setup and oversight. Yet, what exactly is fueling this explosive growth? From the volatility of crypto markets to innovations in energy efficiency, a myriad of factors are at play, making this industry not just a niche endeavor but a cornerstone of the digital economy.

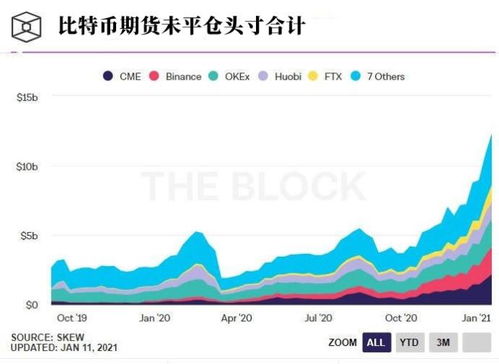

In the heart of this surge lies the enduring dominance of Bitcoin, often abbreviated as BTC, which continues to captivate investors and miners alike with its scarcity and soaring value. As BTC’s price predictions for 2025 flirt with six figures, the demand for efficient mining rigs has skyrocketed, pushing users toward hosting solutions that promise optimized performance and reduced downtime. These hosting providers offer state-of-the-art facilities where miners can plug in their hardware and let professionals handle the rest, ensuring round-the-clock operations in climate-controlled environments. This shift is not merely about convenience; it’s a strategic response to the competitive landscape of blockchain networks, where every hash computed could mean the difference between profit and loss. Meanwhile, the broader ecosystem of exchanges, like Binance or Coinbase, facilitates seamless trading, further incentivizing miners to scale up through hosted services.

Style=”text-align:center;”>

Beyond Bitcoin, the rise of Ethereum (ETH) and its transition to a more sustainable proof-of-stake model has injected fresh dynamism into the hosting market. ETH’s upgrades, such as the highly anticipated Ethereum 2.0, demand less energy-intensive mining rigs, yet they still require robust hosting infrastructure to manage the intricacies of staking and validation. This evolution is drawing in a new wave of participants, from institutional investors to everyday enthusiasts, who seek reliable partners to host their miners without the hassle of personal energy costs or hardware failures. The diversity of cryptocurrencies, including the meme-fueled Dogecoin (DOG), adds another layer of unpredictability, as sudden viral trends can spike mining interest overnight. Hosting providers are adapting by offering flexible packages that cater to various coins, blending cutting-edge technology with user-friendly interfaces to accommodate this eclectic mix.

At the core of this market’s expansion are the mining farms themselves—vast arrays of miners and rigs operating in harmony to crunch numbers and secure blockchains. These facilities, often located in regions with cheap electricity and cool climates like Iceland or Texas, represent the backbone of hosted services. By 2025, advancements in ASIC miners and GPU-based rigs are expected to enhance hash rates while minimizing environmental impact, addressing criticisms of crypto’s carbon footprint. This technological leap is a double-edged sword: it drives efficiency but also intensifies competition, compelling hosting companies to innovate with features like remote monitoring and automated cooling systems. As a result, the market is witnessing a burst of activity, with new entrants challenging established players through aggressive pricing and superior service levels.

Style=”text-align:center;”>

Regulatory environments are another pivotal driver, as governments worldwide grapple with the implications of cryptocurrencies. In 2025, clearer policies in regions like the EU and Asia could legitimize mining operations, boosting confidence in hosting services and attracting more capital. For instance, favorable tax incentives for green mining practices might encourage the adoption of energy-efficient miners, further propelling the market. This regulatory clarity contrasts with the chaos of earlier years, where uncertainty deterred investment. Now, with exchanges becoming more regulated, the synergy between trading platforms and hosting providers is strengthening, creating a more integrated ecosystem that supports everything from BTC halving events to ETH network upgrades.

Finally, the human element cannot be overlooked; the global community’s growing fascination with digital currencies fuels a demand for accessible entry points. Whether it’s a novice setting up their first mining rig or a corporation diversifying its portfolio, hosting services democratize the process, making it easier to engage with assets like DOG without massive upfront investments. As we look toward 2025, the mining machine hosting market’s surge is not just a trend—it’s a transformation, weaving together innovation, adaptability, and opportunity into a tapestry of economic evolution. This vibrant sector promises to continue thriving, driven by the relentless pursuit of digital gold in an ever-changing world.

The 2025 mining machine hosting surge thrives on blockchain tech leaps, energy innovations, and crypto demand spikes, but geopolitical twists and eco-backlash could unpredictably reshape this booming market.