The Ultimate Guide to Purchasing Efficient Bitcoin Mining Equipment

In the rapidly evolving world of cryptocurrency, owning the right Bitcoin mining equipment can be the defining factor between profit and loss. The Ultimate Guide to Purchasing Efficient Bitcoin Mining Equipment dives deep into the multifaceted universe where hardware power meets digital currency generation. With the meteoric rise of Bitcoin, alongside influential currencies like Ethereum and Dogecoin, the demand for robust mining rigs and reliable hosting services has never been higher. Mining isn’t just a hobby—it’s an industrial revolution reshaping the financial landscape.

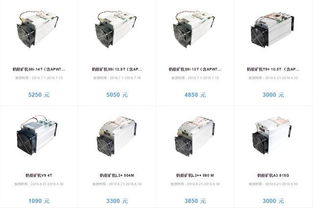

Choosing the correct mining hardware requires a nuanced understanding of the different types of machines available. ASIC (Application-Specific Integrated Circuit) miners have become the gold standard in the Bitcoin mining community due to their unparalleled processing power and energy efficiency. Unlike GPU rigs common in Ethereum mining, ASICs are purpose-built for mining Bitcoin, yielding superior hash rates that directly translate to higher profitability. However, not all ASICs are created equal; factors such as hash rate, power consumption, and price create a delicate balancing act for investors.

Beyond the hardware itself, the infrastructure surrounding mining operations is equally crucial. Mining farms—sprawling complexes housing thousands of miners—epitomize the scale necessary for competitive mining today. However, aspiring individual miners can also leverage mining machine hosting services, wherein companies operate and manage mining rigs on behalf of clients. Hosting offers a solution to those daunted by electricity costs, cooling requirements, and maintenance challenges, democratizing access to mining profits without the logistical headaches.

Bitcoin is often perceived as the quintessential cryptocurrency, but the mining ecosystem encompasses a richer variety. Ethereum, with its distinct proof-of-stake transition, alongside Dogecoin, a rising star originally considered a meme coin, influence mining strategies and hardware choices. Ethereum mining traditionally relies on GPU rigs—versatile, multi-purpose machines that miners can repurpose for different coins. Conversely, Dogecoin, running on the merged proof-of-work consensus with Litecoin, can be mined using equipment initially designed for Litecoin mining but is less demanding than Bitcoin’s immutable chain.

When purchasing mining equipment, mining enthusiasts must consider not just the upfront cost but the total cost of ownership. Electricity bills, cooling systems, and maintenance—technical as it sounds—directly influence returns. Miners with access to renewable energy or lower electricity rates gain a competitive edge, transforming marginally profitable operations into lucrative ventures. Moreover, the environmental impact of mining is an increasingly hot topic, urging companies in the ecosystem to adopt greener solutions and innovate toward sustainability.

The volatility of cryptocurrency markets further complicates equipment selection and deployment. Mining rigs tailored for Bitcoin must adjust to fluctuating mining difficulties and market prices, which can swing profits wildly. This dynamic environment rewards miners who stay informed on blockchain developments, halving events, and shifts in mining pools. On this front, integration with exchanges becomes vital, allowing miners to quickly convert mined assets into fiat or diversify into other cryptos, capitalizing on market opportunities.

Technological advancements continue to reshape mining hardware capabilities. Emerging innovations focus on enhancing efficiency, integrating AI for predictive maintenance, and evolving cooling technologies to prevent overheating in massive mining farms. This tech arms race ensures that miners who invest in outdated machines risk obsolescence and diminished returns. Conversely, being an early adopter of cutting-edge rigs can yield outsized gains but requires careful risk assessment.

In conclusion, purchasing the right Bitcoin mining equipment goes beyond acquiring a powerful machine. It involves a strategic amalgamation of hardware choice, hosting decisions, energy considerations, and market intelligence. Navigating this landscape effectively converts potential pitfalls into sustained profitability. Whether you aim to start a small mining operation, join a large mining farm, or invest in hosting services, understanding the complexities of Bitcoin mining equips you to harness the immense opportunities within the cryptocurrency arena.

A deep dive into ASIC miners! Unveils power consumption secrets and profitability equations. Essential reading before you sink your teeth (and cash) into Bitcoin mining. Volatile markets beware!